Streamline Your WBSO Administration Easily with Traqqie

Streamline Your WBSO Administration Easily with Traqqie

Blog Article

Introduction:

Navigating with the intricacies of WBSO (Damp Bevordering Speur- en Ontwikkelingswerk) administration can be a frightening undertaking For several businesses. From accurately documenting R&D functions to complying with stringent reporting requirements, managing WBSO can consume precious time and means. Nonetheless, with the appropriate applications and solutions in place, companies can streamline their WBSO administration processes, saving time and ensuring compliance. Enter Traqqie – your ultimate companion in simplifying WBSO administration.

What exactly is WBSO and Why is Suitable Administration Critical?

WBSO can be a tax incentive supplied by the Dutch federal government to motivate innovation inside of organizations. It offers a discount in wage tax or nationwide insurance policy contributions for eligible R&D jobs. On the other hand, accessing these Added benefits calls for meticulous administration and adherence to certain recommendations established with the Dutch tax authorities. Failure to maintain right WBSO administration may end up in missed incentives, money penalties, and even audits.

The Challenges of WBSO Administration:

Documentation Load: Companies will have to sustain detailed data in their R&D routines, including task descriptions, several hours worked, and technological progress.

Compliance Complexity: Navigating the intricate principles and regulations of WBSO might be overwhelming, especially for corporations with limited knowledge in tax issues.

Hazard of Mistakes: Guide details entry and calculation increase the threat of glitches, bringing about potential compliance concerns and money setbacks.

Time-Consuming Procedures: Regular ways of WBSO administration contain substantial time and effort, diverting sources from core enterprise functions.

How Traqqie Simplifies WBSO Administration:

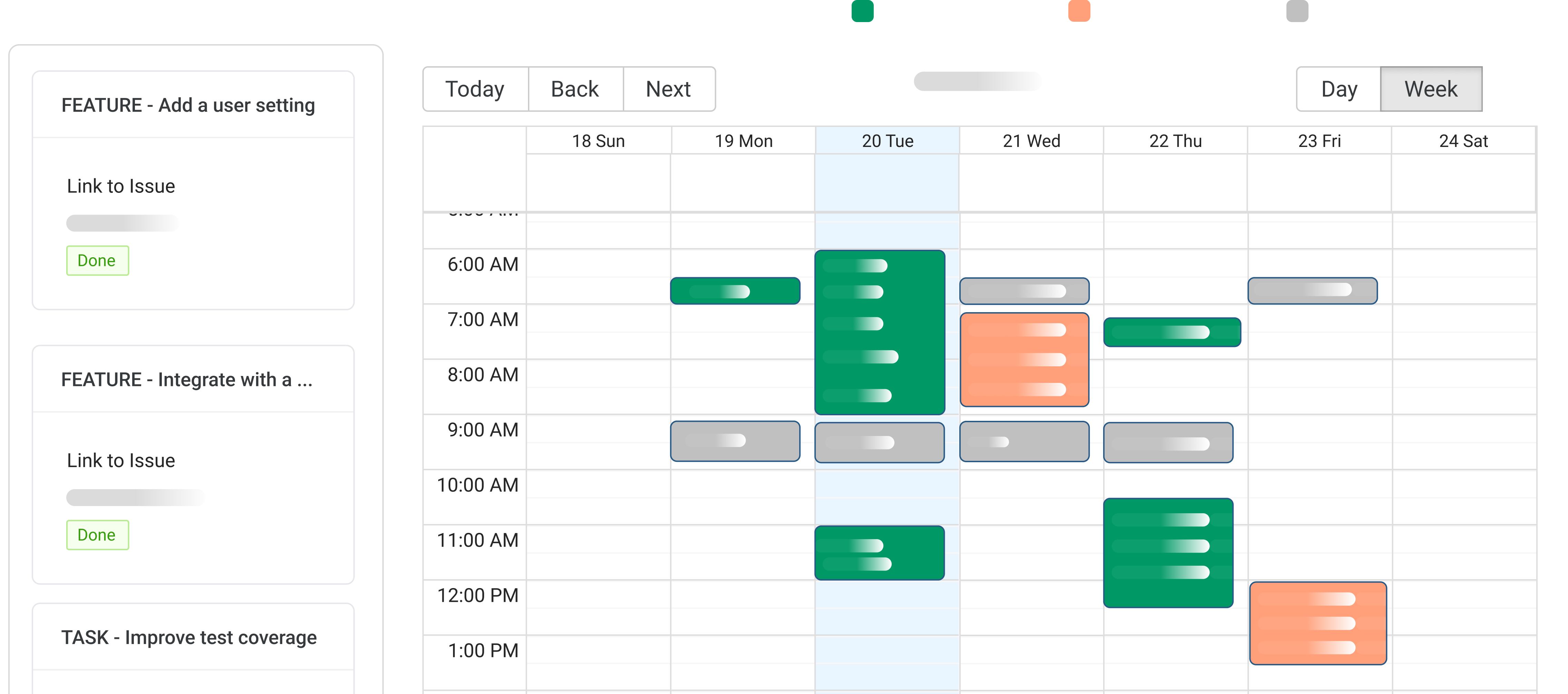

Automatic Documentation: Traqqie automates the documentation course of action by capturing serious-time details on R&D activities, getting rid of the need for handbook report-holding.

In depth Compliance: With Traqqie, enterprises can be certain compliance with WBSO polices as a result of designed-in checks and validations, cutting down the chance of mistakes and penalties.

Efficient Reporting: Generate exact WBSO studies easily with Traqqie's intuitive reporting tools, preserving time and sources.

Streamlined Workflow: Traqqie streamlines the whole WBSO administration workflow, from project registration to submission, building the method seamless and hassle-absolutely free.

Benefits of Using Traqqie for WBSO Administration:

Time Discounts: By automating repetitive tasks and simplifying processes, Traqqie will help organizations help you save valuable time which can be reinvested into innovation and growth.

Enhanced Accuracy: Lessen the chance of faults and make sure precise WBSO statements with Traqqie's Innovative validation mechanisms.

Price tag Efficiency: Minimize administrative expenses associated with WBSO administration and improve the return on the R&D investments.

Reassurance: With Traqqie dealing with your WBSO administration, you may have peace of mind figuring out that your compliance obligations are being met properly.

Summary:

Productive WBSO administration is crucial for corporations seeking to leverage tax incentives to fuel their innovation attempts. With Traqqie, organizations can simplify WBSO administration, streamline processes, and make certain compliance very easily. Say goodbye to your complexities of WBSO administration and good day to a more effective wbso and powerful method of handling your R&D incentives with Traqqie.